In the eyes of investors, the energy storage industry has a bright future and is full of vitality.

"The energy storage industry is a big outlet for investment and financing" "Investors come to us every day for negotiation" "We will soon disclose the financing situation"...Recently, the reporter noticed at the "13th China International Energy Storage Conference" I heard that there are endless voices of capital discussing energy storage.

2022 is the first year for the development of the energy storage industry. This year, the rapid development momentum of the industry is still continuing. In the eyes of investors, the energy storage industry has a bright future and is full of vitality. The industry insiders interviewed all believe that under the background of the carbon peak carbon neutrality target, the energy storage industry has a broad space for development in the next 20 to 30 years.

"All segments are worth investing in"

The "2023 China Energy Storage Industry Innovation Development Research Report" (hereinafter referred to as the "Report") released by the Energy Storage Application Branch of the China Chemical and Physical Power Industry Association shows that in 2022, a total of hundreds of companies related to the energy storage industry will be established. Among them, there are 43 energy storage technology service companies, 54 battery companies and 7 pumped storage companies. In the secondary market, there are currently 293 listed companies related to the A-share energy storage sector. Last year, the capital market paid close attention to the energy storage sector, and market hotspot events took turns in subdivided tracks.

The reporter found in interviews that not only traditional power companies have entered the energy storage track, but also more than 50 other industry leaders such as PetroChina, China Three Gorges Corporation, Xiaomi, Mingyang Smart, and Gree. In order to achieve overtaking in curves and quickly occupy the market, cross-border companies have chosen to establish joint venture subsidiaries with traditional power companies, or acquire energy storage-related companies. For example, in May last year, Midea Group announced that it planned to take control of Kelu Electronics through the method of "fixed increase + entrusted voting rights"; in December last year, Kunlun Wanwei announced that its wholly-owned subsidiary Ningbo Dianjin and Kunlun Nuo Tianqin invested separately and obtained 60% equity of Green Vanadium New Energy.

"Relevant annual reports show that the projects recently launched by chemical companies with a market value of more than 50 billion yuan are all related to new energy." Luan Peiqiang, executive general manager of Jinshi Investment, said, "After in-depth research, we also chose the energy storage track. In the rapid development of the industry At present, all subdivisions of energy storage are worth investing in, but they are only different in terms of investment yield and security."

In the view of Luo Xiaomeng, an investor in Xianfeng Changqing New Energy, the new energy industry chain is long and has many directions, which can form a huge industrial matrix, and there are many investment opportunities in it. The entire energy storage industry is still in the early stages of development. The hot money hype ebbed last year, and the secondary market may pull back in the short term. But venture capital values long-term value, and investment behavior should not be influenced by short-term sentiment. "

Dang Zheng, general manager of the research and development department of Huaneng Investment Management Co., Ltd., said that in the context of building a new power system, energy storage is the cornerstone and indispensable. There are many subdivision tracks for new energy storage, various technical forms, and multiple application scenarios. There are many opportunities, but at the same time, investment difficulties and challenges are also great.

Be wary of packaged "new technologies"

How to invest in energy storage? Should we invest in application scenarios or upstream technologies? The party and the government believe that the industry has reached a consensus on the general direction of energy storage investment, but has not yet reached an agreement on which specific technologies have higher investment value. "At present, I personally pay more attention to new materials. Material progress is the basic driving force for the progress of the energy storage industry, and it is also the core driving force for reducing costs and increasing efficiency. In addition, advanced technology leads a new model of industry development, 'core technology + model leading' It will form a brand effect in the market."

Jiang Xinyu, chairman of Zhiguang Energy Storage, said in an interview with a reporter from China Energy News that at present, it is difficult to find a field with more investment value than energy storage in the power industry, and cross-border enterprises, venture capital, funds, etc. are crowded in Energy storage track. Under the surge of capital, we must be fully vigilant against the "new technology" packaged out of the world to catch the eye. "The energy storage industry strives for reliability, effectiveness, and sustainable development. To avoid 'innovation for the sake of innovation', the industry must verify innovation with actual results, and the capital market and the energy storage industry need rational integration and development."

In addition, many industry insiders told reporters frankly that energy storage investment should focus on two directions: one is disruptive technology, and the other is bottleneck technology.

Lithium battery is still a hot spot

According to the "Report", in 2022, there will be 58 lithium battery investment and financing cases, and nearly 43 companies participating in investment and financing. The total investment amount announced so far has reached 315.087 billion yuan.

For example, Chuneng New Energy Co., Ltd. invested in lithium battery industrial park projects in Xiaogan, Hubei and Yichang in January and May 2022 respectively, with a cumulative investment scale of 105 billion yuan; EVE Lithium Energy even invested 40 billion yuan The power battery industry chain project including lithium batteries, with a total investment scale of 62.6 billion yuan. In addition, battery companies such as Envision Technology, Honeycomb Energy, and Sunwoda have invested tens of billions in lithium batteries.

"In the next 3-5 years, lithium batteries based on lithium iron phosphate will still be the mainstream technology and the main development direction of the market." Liu Yong, Secretary-General of the Energy Storage Application Branch of China Chemical and Physical Power Industry Association, told the reporter of "China Energy News" express.

Luan Peiqiang said that in the lithium battery energy storage system, the integration and battery cells are the most attractive to investors at present. According to the data in January this year, batteries accounted for the highest proportion in the entire energy storage system value chain, reaching about 65%. "We will focus on the most valuable areas to allocate capital, and we will also pay more attention to lithium iron phosphate energy storage battery companies."

However, compared with lithium batteries, sodium-ion batteries have a cost advantage. Liu Yong introduced that, driven by technology and capital, many companies have begun to prepare for mass production of sodium-ion batteries. In the future, extensive verification will be required on energy storage demonstration projects and low-speed electric vehicles, through operating data and experience under different operating conditions Accumulate and optimize the manufacturing process, product quality and product price.

LiPo Batteries and Sustainability: Navigating Environmental Impact

LiPo Batteries and Sustainability: Navigating Environmental Impact

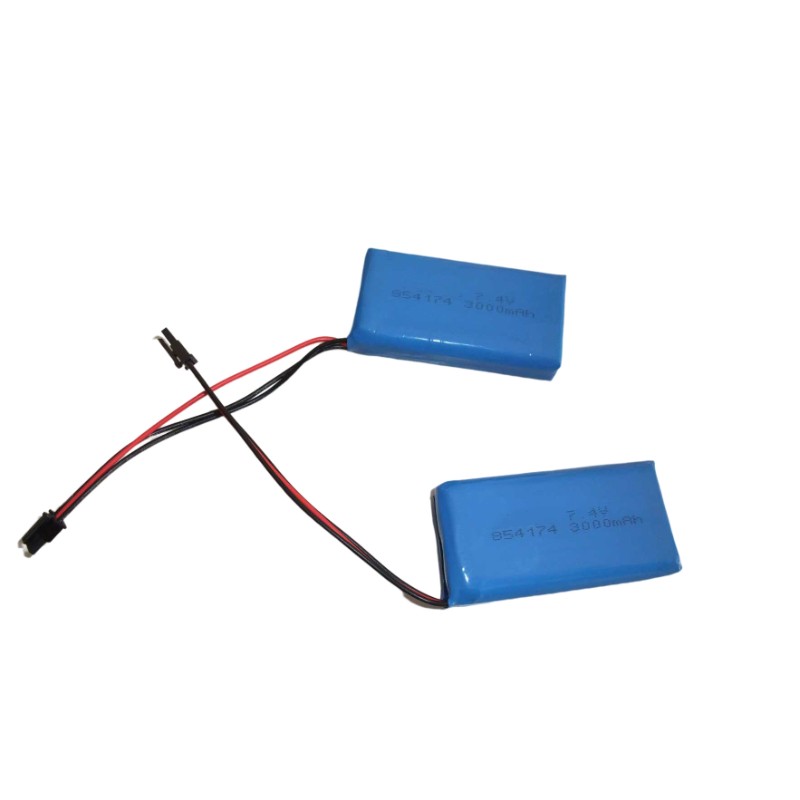

From Concept to Market: The Manufacturing Process of LiPo (Lithium Polymer) Batteries

From Concept to Market: The Manufacturing Process of LiPo (Lithium Polymer) Batteries

LiPo Batteries and Sustainability: Navigating Environmental Impact

LiPo Batteries and Sustainability: Navigating Environmental Impact

Exploring the Advantages and Applications of Lithium Iron Phosphate Batteries

Exploring the Advantages and Applications of Lithium Iron Phosphate Batteries